NCredit – Best Reliable Loan Online For Android – Download

Welcome to NCredit, your reliable loan app in Nigeria, which provides convenient and easy-to-approve cash loan services 24/7. With a commitment to simplicity and flexibility, our platform ensures customers a stress-free loan application experience.

Loan Product Overview

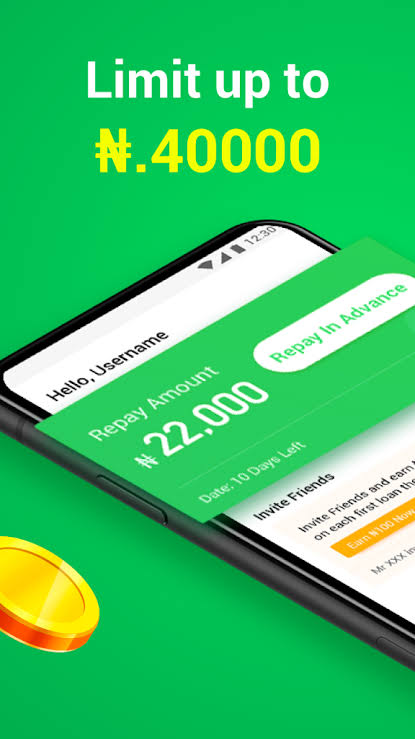

When it comes to meeting your financial needs, NCredit stands out with the following:

- Loan Amount: ₦3,000 – ₦800,000

- Loan Term: 91 days and above

- Interest Rate: 2.5% – 20%, Maximum APR is 20% per year

- Service Fee: 0.1% – 0.5%

Loan Calculation Method

Understanding the cost of your loan is crucial. Here’s an example to help you calculate:

- Loan Amount: ₦4,000

- Loan Term: 1 year

- Interest/Charges: ₦4,000 * 15% = ₦600

- Service Fee: ₦4,000 * 0.4% = ₦16

- Gross Total Repayment Amount: ₦4,616

Key Advantages of NCredit

- Quick and easy online application process

- Fast registration

- No collateral or guarantor needed

- Flexible repayment methods

Loan Requirements

To be eligible for an NCredit loan, you need to meet the following criteria:

- Age: 18~65 years old

- Bank Verification Number (BVN)

- Valid mobile number (for loan-related emergencies)

- Valid Nigerian ID (issued by the local government)

Application Steps

- Download and install NCredit from the Google Play Store

- Register your information and wait for the loan result

- Select your preferred loan amount

- After approval, the amount will be disbursed into your account

- Timely repayment helps increase your credit score for future lending

Data Protection Policy

Your privacy matters to us. NCredit ensures:

- Protection of all customer information

- Secure and confidential handling of customer data

- No disclosure of customer information to third parties without consent

- Customer personal information is used only for verification and qualification evaluation

Contact NCredit

For more information, feel free to reach out:

- Customer Service Hotline: 08166181224

- Email: [email protected]

Why Choose NCredit for Your Financial Needs?

NCredit sets itself apart as your go-to financial solution for various reasons:

- Accessibility: Our 24/7 services ensure you can apply for a loan anytime, anywhere, without the hassle of traditional lending processes.

- Transparent Terms: We believe in clear communication. Our loan terms, including interest rates and service fees, are transparent, so you know exactly what to expect.

- Customer-Friendly: With a user-friendly interface and a fast registration process, we prioritize your convenience. Applying for a loan has never been this easy.

Understanding Your Loan Terms

It’s essential to comprehend the terms of your loan fully. Here’s a breakdown:

- Loan Amount: Choose an amount that suits your needs, ranging from ₦3,000 to ₦800,000.

- Loan Term: Select a repayment period of 91 days and above, giving you the flexibility to manage your finances effectively.

- Interest Rate: Enjoy competitive interest rates between 2.5% and 20%, with a maximum Annual Percentage Rate (APR) of 20% per year.

- Service Fee: A minimal service fee of 0.1% to 0.5% ensures that you can access funds without unnecessary additional costs.

Maximizing Your NCredit Experience

Follow these tips to make the most of your NCredit experience:

- Timely Repayment: Repaying your loan on time not only helps you build good financial habits but also improves your credit score for future lending opportunities.

- Explore Our App: Take advantage of the user-friendly NCredit app. Download it from the Google Play Store, register, and enjoy a seamless loan application process.

- Stay Informed: Regularly check for updates on our services, terms, and new features that enhance your overall experience.

NCredit – Your Trustworthy Partner in Financial Security

Our commitment to your financial security extends beyond providing loans. NCredit prioritizes data protection and customer privacy. Feel confident knowing that your personal information is safe and will only be used for verification and qualification purposes.

Final Thoughts

NCredit is not just a loan app; it’s your reliable companion in times of financial need. With transparent terms, a user-friendly interface, and a commitment to your privacy, we strive to make your lending experience stress-free and secure.

Join NCredit Today!

Discover the ease of obtaining a loan with NCredit. Download our app from the Google Play Store, register, and take control of your financial journey. Your reliable online loan partner is just a few clicks away!

Check More About Ncredit below 👇

Is NCredit Legit?

In today’s fast-paced world, where financial needs can arise unexpectedly, many individuals turn to mobile loan applications for quick and convenient solutions. Among the myriad of options available, NCredit has emerged as a prominent player in the digital lending space. However, before committing to any financial service, it’s essential to understand whether the service is legitimate, safe, and reliable. In this comprehensive overview, we will delve into various aspects of NCredit, including its legitimacy, the process of downloading the app, and other related concerns.

Understanding NCredit

NCredit is a mobile lending platform that offers users a quick and convenient way to access loans through their smartphones. The app promises a streamlined application process, minimal paperwork, and fast disbursement of funds. It is designed to cater to individuals who need immediate financial assistance without the lengthy procedures associated with traditional banks.

Is NCredit Legit?

Determining the legitimacy of any financial service is crucial, as it involves the safety of your personal and financial information. Here are some key factors to consider when evaluating whether NCredit is a legitimate service:

1. Regulatory Compliance

Legitimate financial services, including loan apps, should comply with the regulatory requirements of the country they operate in. This includes adhering to guidelines set by financial authorities, such as obtaining necessary licenses and certifications. To verify NCredit’s legitimacy, you should check if it is registered with relevant financial regulatory bodies and if it complies with the legal standards in your region.

2. **User Reviews and Feedback**

User reviews and feedback can provide valuable insights into the reliability and performance of the app. By researching customer experiences on platforms like Google Play Store, Apple App Store, or independent review websites, you can gauge whether users have had positive or negative experiences with NCredit. Consistently poor reviews or reports of issues like unauthorized charges or difficulties in accessing funds could be red flags.

3. **Security Measures**

A legitimate loan app should prioritize the security of its users’ personal and financial information. Look for information on the app’s security features, such as encryption and secure data storage. Verify if the app follows best practices for protecting user data and if it has any history of data breaches or security issues.

4. **Transparency**

Transparency is another important factor in assessing legitimacy. A reputable loan app should provide clear and detailed information about its terms and conditions, interest rates, fees, and repayment policies. If the app lacks transparency or provides vague information, it may be a cause for concern.

5. **Customer Support**

Reliable customer support is a key aspect of a legitimate financial service. Check if NCredit offers accessible customer support channels, such as phone support, email, or live chat. Efficient and responsive customer service can help resolve any issues or queries you may have.

How to Download the NCredit Loan App

If you have verified the legitimacy of NCredit and wish to use the app, here is a step-by-step guide to downloading and installing it:

**For Android Users:**

1. **Open Google Play Store:** On your Android device, open the Google Play Store app.

2. **Search for NCredit:** Use the search bar at the top of the screen to search for “NCredit.”

3. **Select the App:** Locate the NCredit App from the search results and tap on it.

4. **Install the App:** Click on the “Install” button to download and install the app on your device.

5. **Open and Register:** Once the installation is complete, open the app and follow the on-screen instructions to register and apply for a loan.

**For iOS Users:**

1. **Open the App Store:** On your iOS device, open the App Store.

2. **Search for NCredit:** Use the search function to find “NCredit.”

3. **Download the App:** Tap the “Get” button to download and install the app on your device.

4. **Open and Register:** After installation, open the app and complete the registration process.

NCredit APK Download

For users who prefer to download apps outside the official app stores, it’s possible to download the NCredit APK file. However, this method comes with risks and considerations:

**1. Source of the APK:**

Ensure that you download the APK file from a trusted and reliable source. Downloading APKs from unverified sites can expose your device to malware or compromised versions of the app.

**2. Enable Unknown Sources:**

Before installing the APK, you will need to enable installation from unknown sources in your device settings. This can be done by navigating to Settings > Security > Unknown Sources and toggling the option.

**3. Installation Process:**

Once the APK file is downloaded, open it to begin the installation process. Follow the on-screen instructions to complete the installation. Be cautious of any permissions the app requests during installation.

NCredit Login and Account Management

After downloading and installing the NCredit app, you’ll need to log in to manage your account and apply for loans. Here’s how to log in and what to expect:

**1. Open the App:**

Launch the NCredit app on your device.

**2. Enter Login Credentials:**

Provide your registered email address or phone number and password to log in. If you’re a new user, you may need to create an account first by providing necessary personal information and completing a verification process.

**3. Access Your Account:**

Once logged in, you can access your account dashboard to view your loan application status, manage your loans, and update personal details.

Conclusion

NCredit appears to be a promising option for those seeking quick and convenient loan solutions through a mobile app. However, it’s crucial to thoroughly assess its legitimacy by examining regulatory compliance, user reviews, security measures, transparency, and customer support. If you decide to proceed with NCredit, ensure that you download the app from official app stores or trusted sources and follow best practices for safeguarding your personal information.

By taking these steps, you can make an informed decision about using NCredit and ensure a safe and positive borrowing experience.