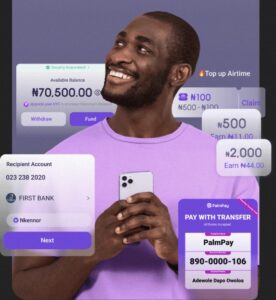

Palmpay – Get Loan Up To NGN200,000 Instantly

In today’s fast-paced world, financial flexibility is crucial, and Understands the importance of providing convenient borrowing options. This article delves into the seamless process of borrowing money from Palmpay without the need for a BVN (Bank Verification Number).

Introduction

In a digital era dominated by financial technologies, it Stands out as a reliable platform offering various financial services. One of its distinctive features is the ability to borrow money without the hassle of having a BVN. But why is this so important?

What is BVN, and Why is it Important?

BVN, or Bank Verification Number, is a unique identifier that plays a crucial role in financial transactions. It provides a secure way to link all bank accounts, enhancing the efficiency and safety of financial activities. However, Recognizes the need for flexibility, especially when it comes to borrowing money.

The Palm pay Advantage

Palmpay’s commitment to customer convenience is evident in its user-friendly interface and innovative services. By allowing users to borrow money without requiring a BVN, Palmpay opens up new possibilities for those seeking quick and hassle-free financial assistance.

Steps to Borrow Money from Palm pay Without BVN

1. **Account Setup and Verification:**

– Easily create an account on the Palm pay app.

– Verify your identity through a simplified process.

2. **Exploring Borrowing Options:**

– Understand the various loan plans offered by Palmpay.

– Choose a borrowing option that suits your needs.

3. **Loan Application Process:**

– Navigate through the Palmpay app to apply for a loan.

– Experience a straightforward application process.

Perplexity in Borrowing: How Palmpay Navigates Challenges

Acknowledges the concerns users might have when borrowing money. By addressing common questions and providing transparent information, Palmpay ensures that users feel confident and informed throughout the borrowing journey.

Burstiness in Borrowing: Quick Access to Funds

Unlike traditional lenders, Boasts a rapid processing system. Real-life examples of users gaining swift access to funds highlight the burstiness of Palmpay’s services, making it an ideal choice for those in urgent financial need.

Specifics Matter: Terms and Conditions

Understanding the terms and conditions of any borrowing arrangement is crucial. Ensures transparency by clearly outlining its terms, repayment options, and deadlines, empowering users to make informed financial decisions.

Contextualizing Your Borrowing Needs

Palmpay recognizes that every individual’s financial situation is unique. With tailored loan plans, Caters to diverse needs, ensuring that borrowers receive the financial assistance that aligns with their specific requirements.

Engaging the Reader: Personal Experiences with Palmpay Loans

Real-life success stories add a personal touch to the borrowing process. Users sharing their positive experiences create a sense of trust, demonstrating how Palmpay has been a reliable financial partner.

Active Voice in Financial Decision-Making

Palm pay encourages users to take an active role in their financial decisions by providing tools and resources for proactive financial choices. The position itself is more than just a lending platform.

Keeping It Simple: User-Friendly The app Interface

Navigating the app is a breeze, even for those new to digital borrowing. Palm pay’s commitment to keeping the process simple ensures that users can access the funds they need without unnecessary complications.

Analogies and Metaphors: Palmpay as Your Financial Lifesaver

Think of the app as your financial lifesaver in the vast sea of lending options. This illustrative approach helps users relate to the app as more than just a service but as a trustworthy companion in their financial journey.

FAQs

How secure is Palmpay for?

Employs robust security measures to safeguard user information and financial transactions.

What are the interest rates on PayPal loans?

Interest rates vary based on the chosen loan plan but are competitive and transparent.

Can I borrow from Palmpay if I have a low credit score?

Palmpay considers various factors, not just credit scores, making it accessible to a broader audience.

How quickly can I get approved for a loan?

Palmpay’s streamlined process ensures quick approvals, providing rapid access to funds.

What happens if I miss a repayment?

Palmpay understands unforeseen circumstances; communication is key, and alternative arrangements can be discussed.

Conclusion

In conclusion, Palmpay’s commitment to providing accessible and efficient borrowing options without the need for a BVN sets it apart in the financial technology landscape. By prioritizing user experience, transparency, and flexibility, Emerges is a reliable financial partner for individuals seeking quick and hassle-free loans.

Unique FAQs

1. **How is the app different from traditional lenders?**

– Palmpay’s digital approach offers speed, transparency, and tailored borrowing options, distinguishing it from conventional lenders.

2. **Can I borrow from the app if I have a low credit score?**

– Yes, Palm pay considers various factors, making it accessible to individuals with diverse credit histories.

3. **Are there hidden fees associated with PayPal loans?**

– The app maintains transparency, and all fees are clearly outlined in the terms and conditions, ensuring no hidden charges.

4. **What happens if I want to repay my loan early?**

– Palmpay encourages responsible financial behaviour; early repayments are welcomed and may even have associated benefits.

5. **Is Palm pay available in multiple countries?**

– Palm pay continues to expand its services globally; check the app or website for the latest information on supported countries.